Majikan yang telah menghantar maklumat melalui e-Data Praisi tidak perlu mengisi dan menghantar CP8D. Select the Year Assessment you will be filing for.

Aplus Software Submit Borang E Cp8d Cuitan Dokter

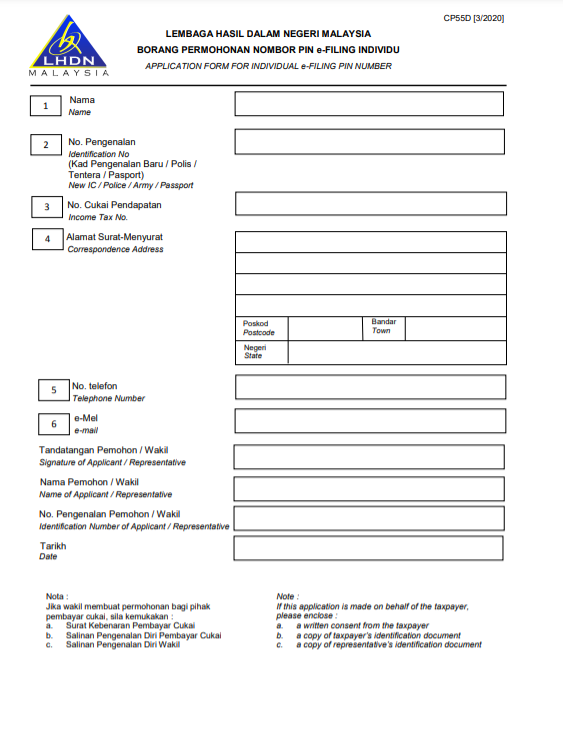

EzHASiL e-Filing Aplikasi e-Filing adalah merupakan sistem yang membolehkan pembayar cukai membuat pengisian dan menghantar Borang Nyata Cukai Pendapatan BNCP dan borang anggaran secara dalam talian.

. J Form of estimated assessment taksiran anggaran issued under subsection 90 3 is for delay in submission of ITRF lewat mengemukakan borang nyata and the corresponding rates are as follows refer point 3 of the GPHDN 52019. Sehubungan itu keseluruhan rangkaian sistem LHDNM meliputi EzHasil Bantuan Sara Hidup dan Bantuan Prihatin Nasional akan ditutup bagi tujuan penyelenggaran seperti berikut. Employers companys particular Details for ALL employees remuneration matters to be included in the CP8D.

Or Company Registration Number then click Proceed. IJJSS2019-Corect2019 Submit Abstract Deadline Submission The new deadline for submission of abstracts is now the 16th September 2019. B Failure to furnish Form E on or before 31 March 2020 is an offence under paragraph 1201b of the Income Tax Act 1967 ITA 1967.

Return Form RF Filing Programme. Tarikh akhir pengemukaan Borang BE Tahun Taksiran 2021 adalah 30 April 2022. BNCP dan borang anggaran yang disediakan dalam e-Filing adalah seperti berikut.

Gunakan satu 1 CD pemacu USB cakera keras luaran untuk satu 1 nombor E. 700 malam hingga 700 pagi. Borang E hanya dianggap lengkap jika CP8D dikemukakan pada atau sebelum tarikh.

Form e-E All companies must file Borang E regardless of whether they have employees or not. New penalty rates for Late filing of Income Tax Returns in Malaysia effective from 1 October 2019. 02 April 2020 Khamis hingga 03 April 2020 Jumaat.

According to the Income Tax Act 1967 Akta 53. ðIsikan 0 di Bahagian A dan Bahagian B Borang E 2010. The new changes will come into effect on 1 September 2018 and involves only ATIGA Scheme as to accommodate e-form D ATIGA.

Cara Isi Borang 17a Khas 2021 Kekalkan Caruman Kwsp 11 Dari 9 Weather Weather Screenshot. Borang b 2019 due date. Select form type e-E and input your Income Tax No.

Dec 22 2020 Members who wish to. BORANG E 2019 Last submission is on or before 31st March 2020 最后提交日期为2020年3月31日或之前. KWSP 7 Borang E.

Majikan yang aklumat melalui e-Data Praisi tidak perlu mengemukakan Borang CP8D. F E 2019 2 UNDER SUBSECTIO COMPLETE THE FOLLOWI Employers no. B Kegagalan mengemukakan Borang E pada atau sebelum 31 Mac 2020 adalah menjadi satu kesalahan di bawah.

All partnerships and sole proprietorships must now file this form as well. July 5 2022 Deadline Full Paper Submission. April 30 for manual submission May 15 for electronic filing ie.

1 Tarikh akhir pengemukaan borang. Present July 4 2022 Notification of Abstract. Correspondence address State IMPORTANT REMINDER submitted information via 1 Due date to furnish this form31 March 20 a Form E will only be considered complete if CP8D is submitted on or before 31 March 2020.

Mulai Tahun Taksiran 2019 Perkongsian Liabiliti Terhad Badan Amanah dan Koperasi hendaklah mengemukakan anggaran cukai secara. Tambahan masa diberikan sehingga 15 Mei 2019 bagi e-Filing Borang BE Borang e-BE Tahun Taksiran 2018. Form E Borang E is required to be submitted by every employer companyenterprisepartnership to LHDN Inland Revenue Board IRB every year not later than 31 March.

Employers who have e-Data Praisineed not complete and furnish CP8D. Every employer shall for each year furnish to the Director General a return in the prescribed form. Borang E is an Employers annual Return of Remuneration for every calendar year and due for submission by 31st March of the following calendar year.

Jika pembayar cukai mengemukakan Borang e-BE Tahun Taksiran 2018 pada 16 Mei 2019 BN tersebut akan dianggap sebagai lewat diterima mulai 1 Mei 2019 dan boleh. Tambahan masa diberikan sehingga 15 Mei 2022 bagi e-Filing Borang BE Borang e-BE Tahun Taksiran 2021. ðBorang E yang diterima itu perlu dilengkapkan dan ditandatangani.

Jika pembayar cukai mengemukakan Borang e-BE Tahun Taksiran 2021 pada 16 Mei 2022 BN tersebut akan dianggap sebagai lewat diterima mulai 1 Mei 2022 dan. Majikan digalakkan mengemukakan CP8D secara e-Filing sekiranya Borang E dikemukakan melalui e-Filing. ðMenghantar surat makluman ke Cawangan di mana fail Majikan berada untuk tindakan supaya Borang E tidak lagi dikeluarkan pada masa akan datang sehinggalah syarikat tersebut beroperasi semula.

Borang Permohonan Pindaan Anggaran Cukai Bulan Ke-11 Tempoh Asas bagi Tahun Taksiran 20212022. The following information are required to fill up the Borang E. Schedule On Submission Of Return Forms RF Contoh Format Baucar Dividen.

In this example 2019. Pengemukaan CP8D melalui disket TIDAK dibenarkan. Most employers should have already issued notices on this and have hard copies for the form available as the deadline for submission is 31 march 2020.

Borang B Submission Date - Personal Income Tax E Filing For. Any dormant or non-performing company must also file LHDN E-Filing. September 11 2019 Posting Komentar.

E Filing Lhdn 2019. Failure to submit the Form E on or before 31 March 2020 is a criminal offense and can be prosecuted in court. Fill in your company details and select MUAT NAIK CP8D in the dropdown.

31 Mac 2020 a Borang E hanya akan dianggap lengkap jika CP8D dikemukakan pada atau sebelum 31 Mac 2020. Select e-Borang under e-Filing.

How To Step By Step Income Tax E Filing Guide Imoney

Aplus Software Submit Borang E Cp8d Otosection

Form Be For Reference Only Pdf Lembaga Hasil Dalam Negeri Malaysia Return Form Of An Individual Resident Who Does Not Carry Business Under Section Course Hero

It S Income Tax Season Again But Don T Worry Here S A List Of All The Things You Can Claim As A Tax Relief For Ya 2021 Wau Post

What Is Borang E Every Companies Need To Submit Borang E Otosection

What Is Borang E Every Companies Need To Submit Borang E Otosection

Aplus Software Submit Borang E Cp8d Otosection

How To Use Lhdn E Filing Platform To File Ea Form Borang Otosection

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

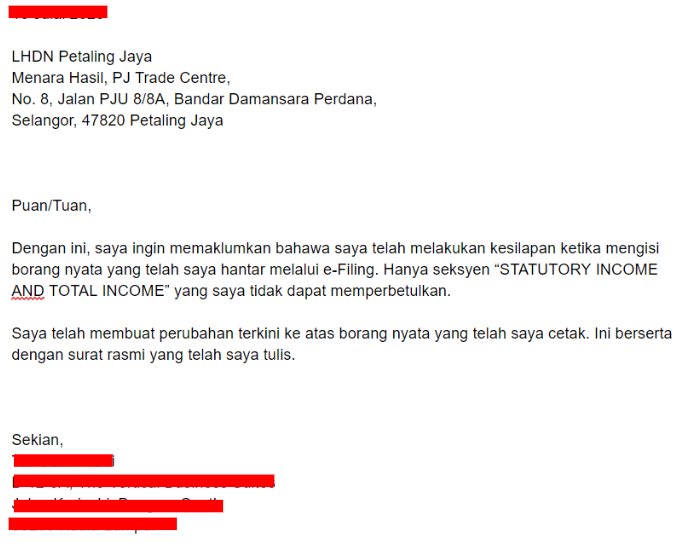

How To Fix A Mistake In Your E Filing For Malaysians By Juinn Tan Medium

How To Use Lhdn E Filing Platform To File Ea Form Borang Otosection

Corporation Income Tax Filing Scarborough Filing Taxes Tax Consulting Income Tax

How To Step By Step Income Tax E Filing Guide Imoney

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

How To Use Lhdn E Filing Platform To File Ea Form Borang Otosection

Confluence Mobile Community Wiki